Here's a tale from

Denver Post proving that even "Captain Dumbass" is not immune from mortgage fraud.

**

Barbara Mattern called Altus Real Estate as soon as she heard the radio ad touting no mortgage payments for a year.

The "Freedom Loan" sounded too good to be true. For Mattern, who later lost her Morrison home to foreclosure, it was.

Mattern didn't qualify for the offer, so she took a loan with a low interest rate and monthly payments to refinance her home. Months later, she realized that the monthly payment to cover principal and interest was three times what she had expected.

"I wish I had never signed those loan papers," she said.

She's not the only one.

The Denver/Boulder Better Business Bureau has received 20 complaints about Altus during the past three years, more than any other mortgage company in Colorado. Five involve allegations that Altus brokers lied or misled them about loan terms.

Altus owner Ferren Rajput said in a statement that 15 of the complaints have been resolved. He added that the BBB complaints are a tiny fraction of the loans Altus handled in the past three years.

All loan terms are disclosed to customers prior to closing, Rajput said.

"The vast majority of Altus customers have been very satisfied," he said.

Rajput, 42, pleaded guilty last month to failure to pay $1.1 million in employment taxes from Altus Financial Inc., a predecessor to Altus Real Estate that went bankrupt in 2004. A judge told him jail time is likely.

Mortgage brokers play a key role in the American dream of homeownership. They connect borrowers with banks in more than two-thirds of mortgage transactions.

They can earn thousands of dollars more on some loans than on others. Lenders, for example, pay brokers based on a loan's profit margin.

Yet, deceptive practices by some brokers are helping to push homeowners into foreclosure, experts say.

"It's a serious problem. People are getting into loans they can't afford," said Colorado Attorney General John Suthers. "That puts them at a higher risk of foreclosure."

The state's foreclosure rate has led the nation for eight consecutive months, according to RealtyTrac, a California company that tracks foreclosures. One of every 327 Colorado homes is in the foreclosure process.

Some brokers take advantage of consumers with misleading advertising and sales tactics, luring them into expensive loans.

A typical pitch involves describing a loan with a rock-bottom interest rate as "fixed" or with a "fixed payment." But rather than a 30-year fixed-interest loan, it's an adjustable-rate mortgage with a one-month introductory rate and a minimum-payment option that builds up debt that can crush a homeowner.

It's buyer beware. Borrowers who fail to carefully read and understand their loan documents before signing have little legal recourse.

"The payment shock that comes with many of these option-ARMs ... is already leading to high foreclosures, and that rate is only going to go up," said Debbie Goldstein, executive vice president of the Center for Responsible Lending in Durham, N.C.

Registration soon mandatory

Colorado will soon take its first step toward regulating mortgage brokers. They must register through the state Division of Real Estate and pass criminal background checks as of Jan. 1. More than 1,100 brokers have either been approved or are awaiting a background

Mortgage Problems?

Have you obtained a mortgage, through a broker, that subjected you to higher payments than you expected when you signed the papers? Has that forced you into foreclosure or put you at immediate risk of foreclosure? If so, please contact Greg Griffin at The Denver Post, 303-954-1241 or ggriffin@denverpost.com.

check.

Brokers with convictions for crimes involving fraud, theft or deceit in the past five years will be barred from the business, as will those who have lost licenses in other states for those reasons.

The new law doesn't go far enough, some say. Unlike real-estate brokers and appraisers, mortgage brokers still won't need to be licensed. That means the state will not require training and cannot investigate and discipline rogue brokers.

Arizona, North Carolina and Oregon are states that require education, three years of experience and an exam before licensing. Prior to its new law, Colorado was one of just two states - Alaska is the other - that didn't regulate mortgage brokers at all.

Critics will be pushing for licensing legislation at the statehouse next year.

"You should have to take a test," said Chris Streiff, director of the Denver- based Society of Mortgage, Appraisal, Real Estate and Title Professionals. "You've got somebody's largest financial investment in your hands. You ought to know what you're doing."

The big opponent of licensing is the Colorado Mortgage Lenders Association, which says additional regulation will hurt the industry and drive up consumers' costs. The group advocates more enforcement.

But despite a rising number of complaints, there's been little enforcement of existing laws that protect consumers from unscrupulous brokers in Colorado.

Suthers' office has yet to prosecute such a case. The office recently began investigating a handful of mortgage companies for deceptive marketing. Suthers would not say if Altus is among them.

Altus has never been charged with deceptive advertising or illegal sales tactics.

However, some of its brokers have run afoul of the law, either before or after working at Altus companies.

Thomas and Janel Skinner, who worked for Altus Financial from 2001 to 2003, went to jail last year after pleading guilty to falsifying documents and defrauding lenders in 2000 and 2001, pocketing $274,800. The activities occurred before they worked for Altus.

A federal grand jury indicted former Altus Financial broker Torrence James in August in an alleged $2.1 million fraud ring. James has pleaded not guilty. The alleged mortgage fraud occurred after he left Altus.

It's unclear what effect Colorado's new mortgage-broker law will have on Altus' operations.

Mortgage companies are not regulated, just brokers. Though his tax charge could disqualify him from brokering loans, state officials said, it would not keep Rajput from owning a mortgage brokerage.

If any current Altus brokers have fraud convictions, they would be barred from originating loans under the new law.

"To the best of Altus' knowledge, no mortgage brokers affiliated with Altus have any felony criminal record," wrote Sean Paris, an attorney for Rajput, in an e-mail in response to The Denver Post.

Talked into a different loan

Mitch Hyder cringes as he looks through the loan-refinancing documents he signed in December 2005.

There, on one document, is the 7.46 percent interest rate. Another document spells out details of his option ARM, an adjustable-rate mortgage with a variety of payment options.

His mortgage brokerage: Altus Real Estate. Hyder called Altus after hearing a radio spot offering no payments for 12 months. His wife, Reva, had quit work after they adopted a daughter, and they needed help adjusting to one income.

Hyder said the broker quickly talked him into a different loan, with a 2.9 percent interest rate for five years. The broker never told him it was an option ARM or that the low numbers were for a payment that would cause his loan debt to grow up to 125 percent of the original balance, Hyder said.

He admits he didn't read the closing documents carefully, relying instead on what the broker told him.

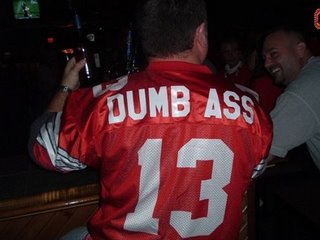

"I now call myself Capt. Dumbass," said Hyder, 43, a radio sports announcer who calls games for the University of Denver Pioneers basketball team.

Hyder's $244,000 loan and an accompanying $48,800 equity line of credit were through lender Washington Mutual. Altus collected $11,100 in fees, $7,800 from Washington Mutual and $3,300 from Hyder.

"We're making the minimum payment and losing all the equity in our home," Hyder said. "It's going to be a very expensive lesson."

The Hyders are trying to determine what's next. They hope Reva doesn't have to take a job, but they don't want to sell the house at a loss or, worse, lose it to foreclosure.

Barbara Mattern's experience was similar. The former Morrison resident said she was told by an Altus broker that the monthly payment on her $556,0000 loan would be less than $1,000. But when her first mortgage-payment stub arrived in mid-2005, the principal-and-interest payment was about $3,000, she said.

Mattern, 58, walked away from the home she loved. The loan was just one factor in her foreclosure. Others included a divorce, loss of her business, bankruptcy and the purchase and loss of yet another house - in Lakewood.

Now she's living with a relative in Nebraska, and her belongings are in storage. "I don't know what I'm going to do," she said. "I'm just kind of lost right now."

In a written statement, Rajput said this about the Mattern and Hyder cases:

"In both of these instances, full disclosure was made both verbally, and in writing, through the closing documents. Further, each also had three days after closing, ... in which time they could cancel their transaction without penalty. In each of these cases, the customer expressed a need to increase monthly cash flow. In each case that objective was met."

More disclosure on risky ARMs

Deceptive lending practices have been gaining the attention of regulators and lawmakers nationwide.

Federal regulators recently issued stricter guidelines directing banks to disclose more to customers about risky adjustable-rate loans. Banks were instructed to use the highest possible interest rate to qualify borrowers.

The Federal Trade Commission has sued 21 mortgage companies in recent years for unfair practices. An affiliate of Citigroup Inc. paid $215 million in 2002 to settle claims in the largest case.

Last year, the FTC secured a $128,300 judgment against Colorado Springs mortgage broker Phillip Ranney for advertising no-cost, low-interest loans that weren't delivered.

Altus owner Rajput said his company's ads - which have run prominently in The Denver Post and Rocky Mountain News business sections and on radio stations - comply with the federal Truth in Lending Act.

The company's ads catch the eye with offers such as 12 months without payments, no closing costs, or both. A recent Altus print ad touted a 4.6 percent rate on a 40-year fixed mortgage. In fine print, Altus discloses it is an "equivalent bi-weekly rate," which accelerates the borrower's repayment of the loan.

Another Altus newspaper ad quotes a $685 monthly payment on a $350,000 loan. It's unclear what kind of loan it is or what interest rate it carries.

Altus isn't the only Denver-area mortgage company running such advertising. Many brokers advertise interest rates as low as 1 percent for five years. Typically those are one-month rates on loans that could put borrowers deeper in debt later on.

Altus spent a quarter of its revenue on marketing in 2004, according to documents from Rajput's bankruptcy. Rajput has said Altus' sales will be about $4 million this year.

The ads work. The phones in Altus' office in the Inverness business park in Douglas County ring constantly, according to former brokers.

"The sole purpose of these ads is to get people to pick up the phone and call," said Bill McClearn Jr., who worked for Altus Financial in 2003.

McClearn said he wasn't pressured by Rajput or Altus managers to put people in loans they couldn't afford.

The temptation to do so is there for any broker. Loans with higher rates or prepayment penalties can boost the lender-paid broker commission by one to three percentage points, or up to $9,000 on a $300,000 loan.

A former Altus broker said Altus tried to put customers into high-commission loans. "I was asked by a manager 'Why aren't you selling the option-ARM?"' said the former broker, who asked not to be named.

Rajput said brokers using "shady tactics" will be fired. In a September interview, he said that fewer than one third of Altus' loans are option-ARMs.

"When offering an option ARM mortgage ... it is Altus' company policy that the loan officer discusses all the pros and cons. ... We understand that this loan is not appropriate for all customers," he said. Altus brokers "present other mortgage programs so the customer can make an intelligent decision."

In all cases, Rajput added, customers sign legally binding documents explaining their loans.

That pinpoints a challenge for law enforcement. The 18th Judicial District Attorney's office has received at least 18 complaints about Altus.

Those customers "all signed the closing documents," said Mason Finks, the district's director of fraud prevention. "That's a hard thing to overcome."

Here's an account of a nephew who is advised to turn down an inherited Miami condo! Seems his rich uncle left him with more than just a ritzy pad... He got mounds of debt too! The story from the Star News of North Carolina.

Here's an account of a nephew who is advised to turn down an inherited Miami condo! Seems his rich uncle left him with more than just a ritzy pad... He got mounds of debt too! The story from the Star News of North Carolina.